|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

The Best Lender to Refinance Home Loan: A Complete Beginner's GuideRefinancing your home loan can be a strategic financial move, but selecting the right lender is crucial. This guide will help you navigate the options available and make an informed decision. Understanding the Basics of Home Loan RefinancingRefinancing your mortgage involves replacing your existing loan with a new one, often to secure a lower interest rate or adjust the loan term. It can save you money over time or provide funds for other financial needs. Benefits of Refinancing

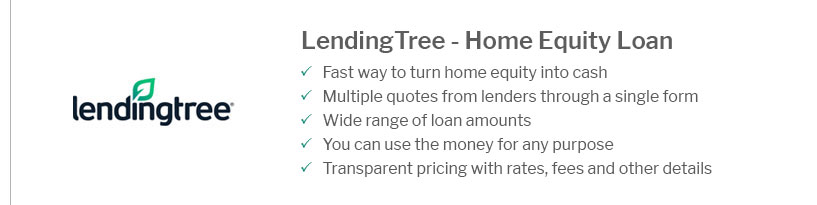

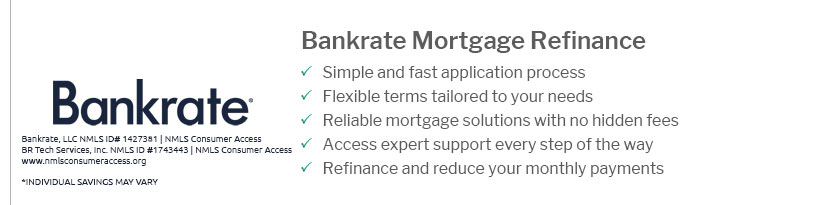

Choosing the Best LenderFinding the best lender involves comparing offers from different financial institutions. Consider the following factors: Interest Rates and FeesCompare the best home equity refinance rates to ensure you're getting a competitive offer. Pay attention to associated fees that could affect the overall cost. Customer ServiceOpt for lenders known for excellent customer service, as this can impact your refinancing experience. Special ProgramsSome lenders offer specific refinancing programs such as FHA streamline refinancing. Check out the best FHA streamline refinance lenders to explore these options. Steps to Refinance Your Home Loan

FAQs

https://money.usnews.com/loans/mortgages/mortgage-refinance-lenders

Best Mortgage Refinance Lenders of January 2025 - Best Mortgage Lenders for Refinancing - Lenders in More Detail - Rocket Mortgage - PenFed Credit Union - New ... https://www.creditkarma.com/home-loans/i/best-banks-refinance-mortgage

5 best banks to refinance a mortgage - Ally Bank mortgages at a glance - Chase mortgages at a glance - Citibank mortgages at a glance - Fifth Third ...

|

|---|